Global Standards Against Money Laundering and Terror Financing

1. FATF, created at the 1989 G7 Paris Summit, is an independent inter-governmental body that sets global standards to combat money laundering, terrorist financing, and proliferation financing effectively.

2. FATF standards help authorities trace illicit funds linked to drug trafficking, illicit arms trade, cyber fraud, and other serious crimes, reinforcing coordinated national and international responses globally.

3. Through its 40-member structure, FATF has enabled more than 200 countries and jurisdictions to commit to implementing standards, strengthening global protections against organised crime, corruption, and terrorism.

4. FATF publishes two public documents three times yearly, identifying jurisdictions with weak AML/CFT measures and spotlighting strategic deficiencies requiring corrective actions by governments and financial sectors.

5. Grey list jurisdictions are under increased monitoring, working with FATF to fix deficiencies within agreed timelines; they commit to reforms against money laundering, terror, and proliferation financing.

6. On 13 June 2025, the grey list included Algeria, Nepal, and South Africa among others, indicating compliance gaps and the need for sustained monitoring and reform implementation.

7. Blacklist jurisdictions face a call for action and enhanced due diligence; on 13 June 2025, Democratic People’s Republic of Korea, Iran, and Myanmar were listed for countermeasures.

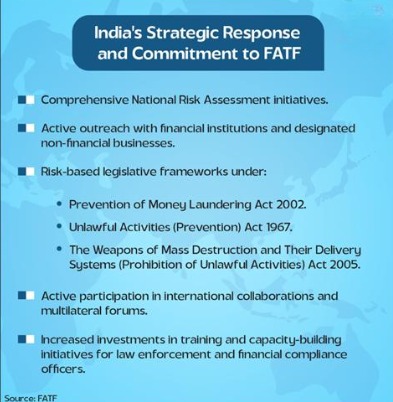

8. India became a FATF observer in 2006 and joined as the 34th member in June 2010, following an on-site mutual evaluation during November–December 2009 for compliance assessment.

9. India applies risk-based legislative frameworks under the Prevention of Money Laundering Act, 2002 and the Unlawful Activities (Prevention) Act, 1967 to deter illicit finance domestically and externally.

10. Two 2025 reports highlighted evolving threats: ‘Complex Proliferation Financing and Sanctions Evasion Schemes’ and ‘Comprehensive Update on Terrorist Financing Risks’, offering mitigation recommendations for institutions and regulators.

11. Proliferation financing tactics include obscuring beneficial ownership, misusing virtual assets and cryptocurrencies, and leveraging maritime shipping sectors to bypass sanctions and international regulatory requirements through trade-based channels.

12. India is cited for creating multiple operational and policy coordination mechanisms on proliferation financing, underscoring domestic collaboration, better detection, and stronger international cooperation to counter sanctions evasion.

13. DPRK-linked cyber operations, including a reported 2025 $1.5 billion ByBit theft, illustrate cybercrime’s nexus with proliferation financing and heighten cross-border financial intelligence demands for rapid detection.

14. A case study raised concerns about Pakistan’s state-owned National Development Complex, sanctioned in several jurisdictions; Pakistan is presented as a high-risk regional jurisdiction for proliferation financing currently.

15. Terrorist financing risks show decentralised local cells, blending cash smuggling, hawala, NPO abuse, and crypto settlements; misuse of e-commerce, social media crowdfunding, and gaming platforms persists significantly.

Key Takeaways

• The Financial Action Task Force (FATF) was set up in 1989 during the G7 Summit in Paris.

• India became 34th member of FATF in 2010.

• India has declared zero tolerance towards terror financing and money laundering, working actively with FATF.

• India has implemented risk-based legislative frameworks under the Prevention of Money Laundering Act 2002 and the Unlawful Activities (Prevention) Act 1967.

• The two recent reports of FATF in June 2025 provide significant overview of evolving global threats and typologies while offering practical recommendations and mitigation strategies.

Must Know Terms:

1.FATF (Financial Action Task Force): An independent inter-governmental body established in 1989 at the G7 Summit in Paris to set global standards against money laundering, terrorist financing and proliferation financing. It issues a common policy framework and regularly monitors implementation across countries and jurisdictions. India became the 34th member in June 2010 after an on-site assessment in November–December 2009.

2. AML/CFT Frameworks: Anti-Money Laundering and Countering Financing of Terrorism regimes translate FATF standards into domestic law, supervision and enforcement. A risk-based approach prioritises higher-risk sectors, customers and transactions for controls, reporting and investigation across financial and non-financial firms. India operationalises this through legislative tools such as the Prevention of Money Laundering Act, 2002, alongside the Unlawful Activities (Prevention) Act, 1967.

3. Grey List (Increased Monitoring): A public list for jurisdictions with strategic AML/CFT deficiencies that have committed to an agreed action plan and timelines while working with FATF. It is issued in FATF public documents released three times a year. As on 13 June 2025, jurisdictions under increased monitoring included Nepal, South Africa, Nigeria, Haiti, Kenya, Vietnam, Algeria, Lebanon and Monaco.

4. Blacklist (Call for Action): A public list for jurisdictions with serious strategic deficiencies for money laundering, terrorist financing and proliferation financing, triggering calls for enhanced due diligence and counter-measures by other countries. It is updated through FATF public documents and drives stronger safeguards. As on 13 June 2025, jurisdictions subject to a call for action included DPRK, Iran and Myanmar.

5. Proliferation Financing (PF) and Sanctions Evasion: Financing linked to weapons of mass destruction and efforts to bypass international restrictions. A June 2025 report highlights tactics such as hiding beneficial ownership, misuse of virtual assets, and maritime and shipping manipulation. It stresses domestic coordination and international cooperation, stronger suspicious transaction reporting, and information-sharing across public-private stakeholders for detection and disruption effective.

6.Terrorist Financing (TF) Risks: Funding that enables terrorist acts, networks and logistics, increasingly shaped by digital channels and decentralised local actors. A July 2025 update notes continued use of cash smuggling, hawala and NPO abuse, alongside blending with crypto, e-commerce, mobile money and online crowdfunding via social media. It also flags crime–terror convergence and microfinancing by lone actors, gaming.

MCQ

1. The Financial Action Task Force (FATF) was set up in:

(a) 1975 during the UN Summit in Geneva

(b) 1989 during the G7 Summit in Paris

(c) 1991 during the G20 Summit in Rome

(d) 2001 during the UN Security Council session

2. FATF is best described as an:

(a) Inter-governmental treaty court with binding judgments

(b) Independent inter-governmental body setting AML/CFT and PF standards

(c) UN agency regulating global banking interest rates

(d) Regional forum limited to Asia-Pacific jurisdictions

3. FATF’s Standards have been committed to by:

(a) Only 40 countries and no other jurisdictions

(b) More than 200 countries and jurisdictions

(c) Exactly 86 countries reviewed annually

(d) Only G7 and EU members

4. FATF identifies jurisdictions with weak AML/CFT measures through:

(a) One annual confidential bulletin

(b) Two public documents issued three times a year

(c) Daily advisories to central banks only

(d) Only mutual evaluation reports

5. “Grey list” jurisdictions refer to those:

(a) Subject to a call for action and countermeasures

(b) Under increased monitoring, working with FATF to address deficiencies

(c) Granted automatic compliance certification

(d) Exempt from reporting suspicious transactions

6. “Blacklist” jurisdictions are those:

(a) Under increased monitoring without deadlines

(b) With serious deficiencies, subject to call for action and countermeasures

(c) With minor technical gaps only

(d) With fully effective AML/CFT frameworks

7. As on 13 June 2025, jurisdictions subject to a “Call for Action” included:

(a) Algeria, Nepal, South Africa

(b) Democratic People’s Republic of Korea, Iran, Myanmar

(c) Bulgaria, Vietnam, Monaco

(d) Lebanon, Kenya, Namibia

8. India became the 34th member of FATF in:

(a) 2006

(b) 2009

(c) 2010

(d) 2014

9. Consider the following statements about India’s association with FATF:

1. India became an observer in 2006.

2. A joint FATF/APG mutual evaluation team conducted an on-site assessment in Nov–Dec 2009.

3. India was admitted as the 34th member on 25 June 2010.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

10. In the described domestic approach, India has implemented risk-based legislative frameworks under:

(a) PMLA, 2002 and UAPA, 1967

(b) RBI Act, 1934 and FEMA, 1999

(c) Companies Act, 2013 and IBC, 2016

(d) NDPS Act, 1985 and Arms Act, 1959

11. FATF released two key reports in June–July 2025, including:

(a) “Complex Proliferation Financing and Sanctions Evasion Schemes” and “Comprehensive Update on Terrorist Financing Risks”

(b) “Global Banking Stability Report” and “World Payments Outlook”

(c) “Cybersecurity Baselines for Banks” and “Global Sanctions Manual”

(d) “Illicit Trade Routes in Asia” and “Maritime Piracy Risks”

12. The report on proliferation financing and sanctions evasion highlights methods including:

(a) Manipulating beneficial ownership, misusing virtual assets, leveraging maritime/shipping sectors

(b) Banning foreign exchange trading, abolishing customs checks, ending STR filings

(c) Replacing banks with barter trade only, removing KYC norms, suspending audits

(d) Limiting shipping lanes, nationalising ports, prohibiting insurance contracts

13. Regarding Immediate Outcome (IO) 11, the text indicates that:

(a) Only 16% of assessed countries showed high/substantial effectiveness

(b) Over 80% of assessed countries showed high/substantial effectiveness

(c) IO11 is not used for proliferation financing effectiveness

(d) No country has demonstrated substantial effectiveness

14. The terrorist financing update highlights that:

(a) Financing is increasingly centralised in a single international hub

(b) Regional and geographic decentralisation enables local actors in fragmented ecosystems

(c) Only state actors, not non-state networks, finance terrorism

(d) Terror financing is now limited to formal banking channels

15. Consider the following pairs:

1. Hawala networks — Use crypto to settle balances

2. Online crowdfunding — Fundraising under charitable cover

3. Gaming platforms — Income and recruitment opportunities

Which of the pairs given above are correctly matched?

(a) 1 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

0 comment