Regulatory and Digital Reforms Driving India’s Business Environment Transformation

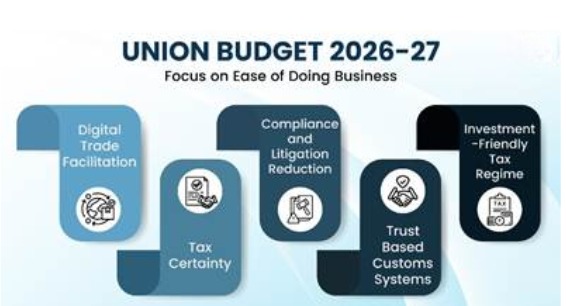

1. Union Budget 2026–27 reiterates Ease of Doing Business as a growth pillar, prioritising digitisation, tax certainty, investor access and litigation reduction to strengthen confidence across sectors nationwide.

2. An interconnected single digital window for cargo approvals is proposed, enabling streamlined customs clearances, reduced interface duplication, faster releases, and lower compliance friction for trade participants and paperwork.

3. Customs Integrated System will be rolled out within two years as an integrated, scalable platform covering end-to-end customs processes, improving interoperability, traceability, and predictability for trade.

4. Non-intrusive scanning using imaging and AI-enabled risk assessment will expand in phases, targeting scanning of every container across major ports to tighten security and reduce delays.

5. Trusted importers will be recognised in risk systems, cutting physical verification, enabling electronically sealed factory-to-ship export clearance, and facilitating immediate release on arrival for compliant filings.

6. For goods without compliance requirements, customs clearance will occur immediately after online registration by the importer, subject to duty payment, shortening dwell time and improving logistics efficiency overall.

7. Portfolio Investment Scheme access is widened for individuals resident outside India to invest in listed equity instruments, enhancing market liquidity and broadening foreign investor participation pathways significantly overall.

8. Individual PROI investment limit under PIS is proposed to rise from 5% to 10%, while the overall ceiling for individual PROIs rises to 24% from 10% in aggregate.

9. Minimum Alternate Tax is proposed as levy at 14% instead of 15%, aiming to reduce disputes, improve certainty, and simplify settlement of MAT liabilities for firms in India.

10. Non-residents paying presumptive tax are proposed to be exempt from MAT, supporting predictable taxation and lowering friction for global businesses operating under presumptive income frameworks in India.

11. MAT credit set-off in the new regime is proposed up to one-fourth of tax liability, easing costs and improving cash-flow planning for firms shifting regimes.

12. Integrated assessment and penalty proceedings through a common order are proposed, with no interest on penalty during appeal and reduced pre-payment requirement from 20% to 10% thereby.

13. Return updating is proposed even after reassessment initiation, with an additional 10% tax above the applicable rate, enabling voluntary self-correction for taxpayers and reducing prolonged disputes materially.

14. Immunity from penalty and prosecution framework is extended from underreporting to misreporting, requiring payment of 100% additional income tax over tax and interest due in specified eligible cases.

15. Duty deferral period for Tier-2 and Tier-3 Authorised Economic Operators is extended from 15 to 30 days, supporting ‘Clear first, pay later’ for time-sensitive production.

Trust-based systems

- Enhanced the duty deferral period for Tier 2 and Tier 3 Authorised Economic Operators (AEO), from 15 days to 30 days.

| What does it mean?

Deferred duty payment is a mechanism for delinking duty payment and Customs clearance. It is based on the principle ‘Clear first-Pay later’. The aim is to have a seamless wharf to warehouse transit in order to facilitate just-in-time manufacturing.

The enhancement in the duty deferral period means extending the time allowed to pay customs or import duties after goods are imported, instead of paying them immediately. |

| Other Single Window Digital Platforms | |

|

PARIVESH (Pro-Active and Responsive facilitation by Interactive, Virtuous, and Environmental Single Window Hub) 3.0 |

For environmental clearances and post-approval compliance monitoring.

It integrates baseline data, afforestation land banks, inter-ministerial dashboards, and AI-enabled support to enhance transparency, predictability, and efficiency.

|

|

e-Gram SWARAJ portal |

Provides a single window with the complete Profile of the GP, including details of Sarpanch/Secretary, demography, finances, assets along with activities taken up through the Gram Panchayat Development Plan (GPDP).

Serving as a unified reporting and tracking platform, it strengthens decentralised planning and improves the effectiveness of development fund utilisation. |

| Achievements of States under BRAP | |

|

Kerala |

|

|

Tamil Nadu |

|

|

Andhra Pradesh |

|

—

Must Know Terms :

1.Ease of Doing Business (EoDB)

Ease of Doing Business refers to a reform-driven framework aimed at simplifying regulatory procedures, reducing compliance costs, and improving predictability for enterprises. In India, EoDB focuses on digitisation, decriminalisation of minor offences, tax certainty, and trust-based governance to enhance investor confidence, promote entrepreneurship, improve competitiveness, and integrate domestic firms with global value chains effectively.

2.Customs Integrated System (CIS)

The Customs Integrated System is a proposed unified digital platform designed to integrate all customs-related processes into a single, scalable architecture. CIS aims to replace fragmented systems, enabling seamless data sharing, end-to-end cargo tracking, faster clearances, improved risk assessment, and enhanced transparency. It supports reduced transaction costs, predictability in trade logistics, and improved ease for importers and exporters.

3.Minimum Alternate Tax (MAT)

Minimum Alternate Tax is a tax mechanism introduced to ensure companies with substantial book profits pay a minimum level of tax despite exemptions. Under recent reforms, MAT is proposed as a final tax at a reduced rate of 14 percent, improving tax certainty, lowering litigation, enabling better financial planning, and reducing prolonged disputes between taxpayers and tax authorities.

4.Portfolio Investment Scheme (PIS)

The Portfolio Investment Scheme regulates equity investments by persons resident outside India in listed Indian companies. Recent enhancements permit wider access and higher investment limits for individual foreign investors. These reforms aim to deepen capital markets, improve liquidity, diversify investor participation, and align India’s financial markets with global investment practices and standards.

5.Authorised Economic Operator (AEO) Programme

The Authorised Economic Operator programme accredits compliant and trusted trade entities, granting them facilitative benefits in customs procedures. Enhanced duty deferral periods and preferential treatment under risk management systems reduce inspections and delays. The programme strengthens supply chain security, supports just-in-time manufacturing, improves logistics efficiency, and promotes trust-based customs administration.

6.ational Single Window System (NSWS)

The National Single Window System is a digital clearance platform guiding businesses through approvals required across central and state authorities. It integrates hundreds of approvals into one portal, reduces approval timelines, improves document management, and enhances transparency. NSWS plays a critical role in reducing procedural complexity and facilitating faster project implementation nationwide.

Key Takeaways

- Union Budget 2026-27 reinforces Ease of Doing Business as pillar of growth and development, while focusing on digitisation, tax certainty, investor access and litigation reduction.

- Focus on digital trade facilitationby single, interconnected digital window for custom clearance and Custom Integrated System.

- For deepening market liquidity and investor access, PROI investment limits under Portfolio Investment Scheme enhanced.

- MAT proposed as final tax with a lower rate of 14%, enhancing tax certainty and reducing disputes.

- Trusted importers recognised in risk systems, reducing physical verification and enabling factory-to-ship clearance.

MCQ

1. The Customs Integrated System is planned to be rolled out within:

A) 6 months

B) 1 year

C) 2 years

D) 5 years

2. The proposed approach for cargo approvals is:

A) Multiple separate portals

B) Single interconnected digital window

C) Manual paper routing

D) State-only clearance desks

3. The scanning reform targets scanning:

A) Only high-risk containers

B) Every container at major ports

C) Only exports

D) Only air cargo

4. Trusted importers in risk systems primarily reduce:

A) Duty rates

B) Physical verification

C) Shipping charges

D) Warehouse rent

5. Factory-to-ship clearance is enabled through:

A) Handwritten permits

B) Electronically sealed export cargo

C) Port-level cash payments

D) Offline gate passes

6. For goods without compliance requirements, clearance occurs:

A) After physical inspection

B) After online registration and duty payment

C) After tribunal approval

D) After bank guarantee

7. PIS access is widened to allow investment by:

A) Domestic mutual funds

B) PROIs in listed equity instruments

C) Only FPIs in bonds

D) Only NRIs in unlisted shares

8. Individual PROI limit under PIS is proposed to rise to:

A) 3%

B) 5%

C) 10%

D) 15%

9. Overall ceiling for individual PROIs under the proposal is:

A) 10%

B) 14%

C) 20%

D) 24%

10. The proposed MAT levy rate is:

A) 12%

B) 14%

C) 15%

D) 18%

11. MAT exemption is proposed for non-residents who:

A) Pay presumptive tax

B) File quarterly TDS returns

C) Export only

D) Have no PAN

12. MAT credit set-off in the new regime is allowed up to:

A) One-tenth

B) One-fourth

C) One-half

D) Full liability

13. Reduced pre-payment requirement for appeals is proposed from 20% to:

A) 5%

B) 10%

C) 15%

D) 25%

14. Updated returns after reassessment initiation require an additional:

A) 5% tax

B) 7.5% tax

C) 10% tax

D) 12.5% tax

15. Duty deferral for Tier-2 and Tier-3 AEOs is extended to:

A) 15 days

B) 21 days

C) 30 days

D) 45 days

0 comment