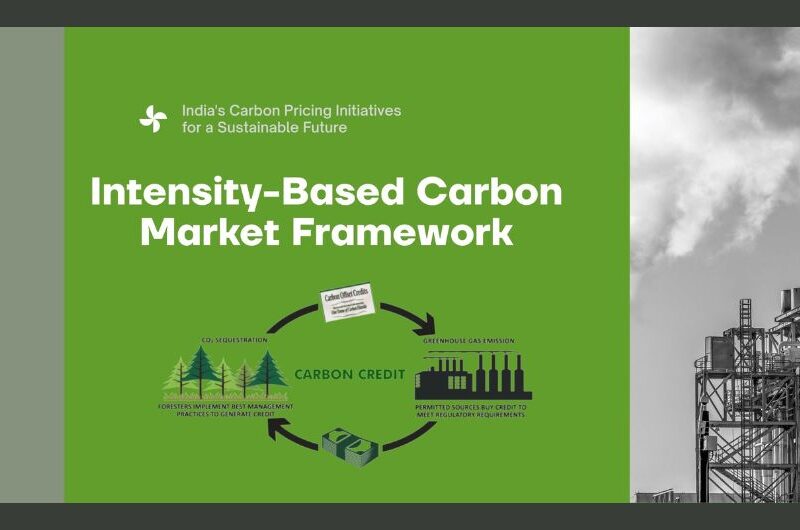

Intensity-Based Carbon Market Framework

1. Carbon Market Buildout: India is developing a regulated carbon pricing ecosystem, combining a rate-based emissions trading system with voluntary crediting to support decarbonisation and climate-aligned growth.

2. Rate-Based ETS Concept: In a rate-based ETS, entities face benchmark emissions-intensity limits rather than absolute caps, allowing flexibility for growth while still rewarding improved efficiency and competitiveness.

3. CCTS Foundation: The Carbon Credit Trading Scheme, notified in July 2024, established the institutional framework for the Indian Carbon Market and links compliance obligations with voluntary offset participation.

4. Initial Sector Coverage: The national ETS is planned to begin with nine energy-intensive industrial sectors, focusing on emissions intensity metrics to drive performance improvements across major emitting value chains.

5. Credit Certificate Logic: Facilities outperforming benchmark emissions-intensity levels will receive credit certificates, creating an incentive structure where efficiency leaders can monetise surplus performance through market mechanisms.

6. Voluntary Methodologies: On 28 March 2025, the Ministry of Power approved eight crediting methodologies enabling voluntary carbon credits, including renewable energy, green hydrogen production, industrial efficiency, and mangrove restoration.

7. PAT Transition Path: India plans a gradual transition during 2025 from the Perform, Achieve and Trade scheme toward the new carbon market architecture, aligning efficiency trading with broader carbon pricing goals.

8. Legal Enabling Framework: The Energy Conservation (Amendment) Act, 2022 provides legal basis for carbon markets and empowers the central government to issue carbon credit certificates for compliant and credited entities.

9. Green Hydrogen Linkage: Carbon market methodologies support the National Green Hydrogen Mission, which targets production of five million metric tonnes annually by 2030, strengthening low-carbon industrial competitiveness.

10. PAT Performance Record: PAT, implemented by the Bureau of Energy Efficiency since 2012, is reported to have reduced emissions intensity in designated sectors by roughly fifteen to twenty-five percent.

11. Renewables Capacity Goal: India aims to install five hundred gigawatts of non-fossil fuel-based capacity by 2030, reinforcing carbon market signals with large-scale clean power expansion.

12. Governance Architecture: Market oversight includes the National Steering Committee for the Indian Carbon Market and the Bureau of Energy Efficiency under the Ministry of Power, supported by rules, procedures, and working groups.

13. Mission LiFE Agenda: Mission LiFE promotes sustainable lifestyles through behavioural change, aiming to mobilise one billion people globally by 2028 and mainstream pro-planet habits across communities and markets.

14. Green Credit Rules: Green Credit Rules notified on 12 October 2023 create a voluntary market mechanism for tree plantation on degraded forest lands, issuing credits via a digital registry with verification and audits.

15. Competitiveness and CBAM: As external pressures like carbon border measures grow, India’s intensity-based ETS offers a pragmatic path to preserve export competitiveness while advancing climate goals and net-zero by 2070.

MCQ:

1. With reference to a rate-based Emissions Trading System (ETS), consider the following statements:

1. Total national emissions are capped ex ante.

2. Entities are assessed against benchmark emissions-intensity levels.

3. It offers flexibility under uncertain growth conditions.

Which of the statements given above is/are correct?

A. 1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

2. India’s carbon pricing framework described here is best characterized by:

A. Cap-and-trade with absolute sectoral caps from inception

B. Intensity-focused trading with both compliance and voluntary elements

C. Purely voluntary offsets without institutional backing

D. Carbon tax with uniform rate across all fuels

3. Consider the following statements about the Carbon Credit Trading Scheme (CCTS):

1. It was adopted in July 2024.

2. It established an institutional framework for a domestic carbon market.

3. It contains a compliance mechanism and an offset mechanism.

Which of the statements given above is/are correct?

A. 1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

4. The credit certificates under the described system are issued primarily to:

A. Entities that exceed benchmark emissions-intensity levels

B. Facilities that outperform benchmark emissions-intensity levels

C. Only renewable-energy generators, irrespective of benchmarks

D. All obligated entities in equal quantities each year

5. The national ETS at the initial stage is stated to cover:

A. Nine energy-intensive industrial sectors

B. All sectors except agriculture

C. Only the power sector

D. Only transport and buildings

6. On 28 March 2025, approval was given for crediting methodologies intended for:

A. Mandatory compliance credits only

B. Voluntary carbon credit generation

C. A carbon tax rate schedule

D. Fossil-fuel subsidy rationalisation

7. Which of the following is included among the approved voluntary crediting areas mentioned?

A. Nuclear power uprating

B. Green hydrogen production

C. Metro rail expansion

D. Coal washing mandates

8. The planned shift in 2025 indicates a transition from which earlier market-based programme toward the new architecture?

A. UDAY

B. UJALA

C. Perform, Achieve and Trade (PAT)

D. KUSUM

9. The legal basis enabling issuance of carbon credit certificates is attributed to:

A. Environment Protection Act, 1986

B. Energy Conservation (Amendment) Act, 2022

C. Forest (Conservation) Act, 1980

D. Electricity Act, 2003

10. The Bureau of Energy Efficiency (BEE), as described, is best understood as:

A. A purely advisory NGO platform

B. A quasi-regulatory body for energy efficiency under the Energy Conservation Act framework

C. A state government department under agriculture

D. An intergovernmental treaty organisation

11. The reported lifecycle outcome of PAT in designated sectors is a reduction in emissions intensity by:

A. 1–5%

B. 5–10%

C. 15–25%

D. 35–45%

12. The renewable capacity ambition cited for 2030 is:

A. 200 GW of fossil capacity

B. 300 GW of nuclear capacity

C. 500 GW of non-fossil fuel-based capacity

D. 750 GW of coal-based capacity

13. Mission LiFE, as described, primarily emphasizes:

A. Technology-only decarbonisation through industrial CCS mandates

B. Behavioural change and sustainable lifestyle practices at scale

C. Trade sanctions against high emitters

D. Mandatory rationing of household electricity

14. The Green Credit mechanism described is best represented by which sequence?

A. Credits issued before planting; no verification required

B. Plantation within two years; maintenance for ten years; credits verified through digital tracking and audits

C. Credits based only on rainfall; no land identification needed

D. Credits issued only to foreign entities via offshore registries

15. The concluding policy rationale highlights that an intensity-based ETS helps India primarily by:

A. Eliminating the need for renewable expansion

B. Maintaining competitiveness under external carbon-related trade pressures while pursuing decarbonisation

C. Replacing all environmental regulations with a single tax

D. Setting immediate absolute caps across all sectors without flexibility

0 comment