Strategic Momentum in India–EU Partnership: Trade, Technology, Security, Connectivity and Mobility

Strategic Momentum in India–EU Partnership: Trade, Technology, Security, Connectivity and Mobility

“Mother of All Deals”

– European Commission President Ursula Von der Leyen

1. India–EU ties gain strategic momentum ahead of New Delhi summit, aiming for a new Joint Strategic Agenda and revival of long-pending Free Trade Agreement negotiations across sectors rapidly.

2. EU became India’s largest goods trading partner, with bilateral merchandise trade about $136 billion in 2024–25, covering machinery, transport equipment, chemicals, metals, mineral products and textiles overall strength.

3. Services trade expanded steadily from 2019 to 2024: Indian exports to the EU rose from €19 billion to €37 billion, while EU exports reached €29 billion there too.

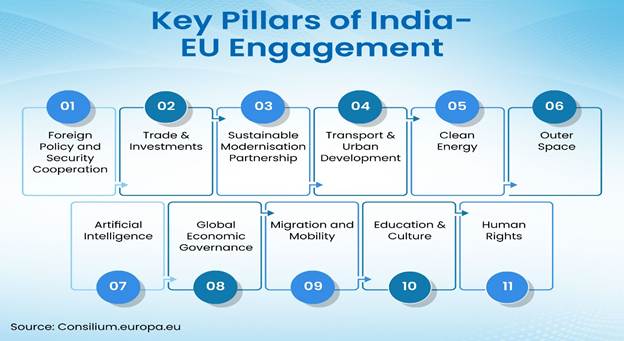

4. Partnership is guided by the 2020 roadmap to 2025, spanning trade, investment, security, defence, climate action, clean energy, digital transition, connectivity, space, agriculture and people-to-people exchanges today widely.

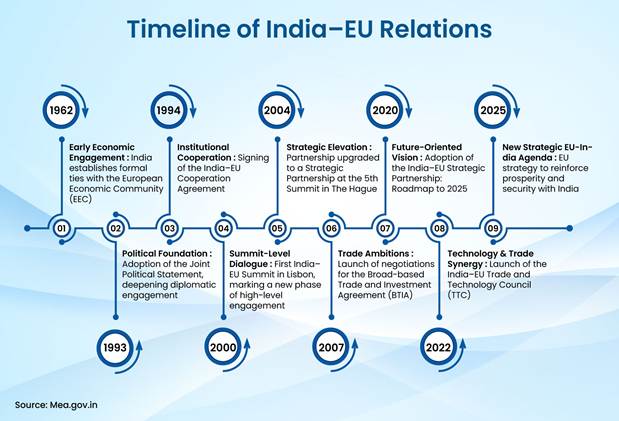

5. Diplomatic links date to 1962 when India engaged the European Economic Community, later formalised through the 1993 Joint Political Statement and 1994 Cooperation Agreement strengthening political-economic cooperation frameworks.

6. The first summit in Lisbon, June 2000, began annual high-level dialogues; in 2004 at The Hague, ties were upgraded to a Strategic Partnership broadening cooperation beyond trade alone.

7. Recent acceleration includes resuming trade and investment talks in May 2021 and launching the Trade and Technology Council in April 2022 for digital and green cooperation jointly implemented.

8. The EU College of Commissioners, led by President Ursula von der Leyen, visited New Delhi in February 2025—the first such visit to a non-European bilateral partner ever recorded.

9. Leaders met alongside multilateral forums including G7 and G20, most recently June 2025 in Canada, and maintained regular telephonic contact through September 2025 calls at top levels often.

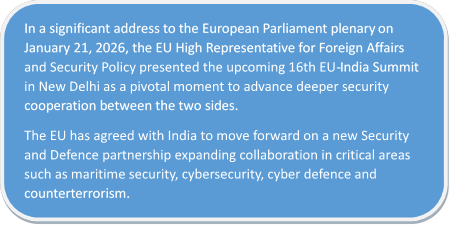

10. Security and defence cooperation advanced in 2025, with agreement to explore a Security and Defence Partnership and ministerial-level interactions on defence and space industries for shared strategic outcomes.

11. Maritime cooperation includes joint naval exercises in the Indian Ocean (June 2025), Gulf of Guinea (October 2023) and Gulf of Aden (June 2021), plus escort operations near Somalia.

12. Energy-climate ties centre on the Clean Energy and Climate Partnership launched 2016; Phase III adopted November 2024, expanding work on renewables, infrastructure, methane reduction and technology transfer initiatives.

13. EU joined the International Solar Alliance in 2018; the European Investment Bank funds sustainable transport and metro projects, while the EU joined CDRI in March 2021 for resilience.

14. Scientific cooperation includes a July 2020 Euratom R&D agreement on peaceful nuclear energy uses, and India’s associate membership of CERN since 2017, supporting frontier research links globally visible.

15. Mobility links are substantial: 931,607 Indian citizens lived in the EU by end-2024, including 16,268 Blue Card holders; over 6,000 Erasmus Mundus scholarships awarded across two decades collectively.

Must Know Terms:

1) India–EU Free Trade Agreement (FTA): Long-pending negotiations aim to reduce tariffs, align standards, and expand market access for goods and services. It matters for export growth, investment confidence, and resilient supply chains. In this topic, both sides seek to “advance” FTA talks ahead of the summit, signalling political intent to convert strategic goodwill into binding economic rules.

2) Joint Strategic Agenda: A proposed guiding document to steer India–EU cooperation beyond the existing Roadmap to 2025. It structures priorities, timelines, and deliverables across trade, technology, climate, security, connectivity, and people-to-people links. Its value is coordination: it converts multiple dialogues into measurable actions, reducing fragmentation between sectoral tracks and ensuring continuity across leadership changes.

3) Trade and Technology Council (TTC): A high-level platform launched to deepen cooperation in digital and green technologies, standards, innovation, and trusted supply chains. It matters because strategic technologies increasingly decide competitiveness and security. In this topic, TTC ministerial meetings reflect a shift from broad dialogues to implementation—working groups can drive outcomes on semiconductors, AI governance, clean-tech value chains, and regulatory alignment.

4) Clean Energy and Climate Partnership (CECP): The core framework for India–EU collaboration on climate action and energy transition, established in 2016 and expanded through successive phases. It covers renewables, methane reduction, infrastructure resilience, finance, and technology transfer. Its significance is practical support—mobilising expertise and capital to accelerate decarbonisation while balancing development needs, and linking climate goals with industrial policy.

5) India–EU Connectivity Partnership (2021): A strategic initiative to develop sustainable, inclusive, resilient connectivity across transport, digital infrastructure, and energy networks. It matters for diversification away from single-route dependencies and for creating transparent, high-standard infrastructure models. In this topic, it supports movement of goods, services, data, and capital, and complements corridor-style initiatives through coordinated planning and financing.

6) Common Agenda on Migration and Mobility (CAMM) (2016): A structured framework to manage legal migration, skilled mobility, social security issues, and orderly pathways, aligning EU demographic needs with India’s workforce advantages. It matters for people-to-people ties and economic complementarity. In this topic, dialogues propose mechanisms like a Legal Gateway Office and youth mobility frameworks to operationalise access.

Key Takeaways

- India’s engagement with the EU highlights its strategic focus on Europe, aligned with the upcoming India-EU Summit and the ongoing Free Trade Agreement.

- Bilateral trade volume reached approximately $136 billion in 2024-25, making the EU India’s largest goods trading partner.

- Between 2019 and 2024, India-EU bilateral trade in services grew steadily, with Indian exports rising from €19 billion to €37 billion and EU exports to India increasing to €29 billion.

- As of 2024, over 931,607 Indians resided in the EU, including 16,268 Blue Card holders, and in the past 20 years, more than 6,000 Indian students received Erasmus Mundus scholarships, highlighting India–EU mobility and educational ties.

MCQ

1) With reference to the India–EU Partnership described, which of the following is/are stated as immediate drivers of renewed strategic momentum?

1) Forthcoming India–EU Summit in New Delhi

2) Intensification of engagement to advance long-pending FTA negotiations

3) Adoption of a new Joint Strategic Agenda beyond the existing roadmap

Select the correct answer using the code given below:

A) 1 and 2 only

B) 2 and 3 only

C) 1 and 3 only

D) 1, 2 and 3

2) As per the data mentioned, the EU is described as India’s largest goods trading partner in:

A) 2021–22

B) 2022–23

C) 2023–24

D) 2024–25

3) Consider the following statements about India–EU trade in services (2019 to 2024) as mentioned:

1) Indian exports rose from €19 billion to €37 billion

2) EU exports to India increased to €29 billion

Which of the statements given above is/are correct?

A) 1 only

B) 2 only

C) Both 1 and 2

D) Neither 1 nor 2

4) With reference to mobility indicators cited, which of the following is/are mentioned?

1) Total Indians residing in the EU as of end-2024 exceeded 9 lakh

2) Indian citizens formed the largest group of Blue Card holders, with 16,268 in 2024

3) Over 6,000 Indian students received Erasmus Mundus scholarships in the last 20 years

Select the correct answer using the code given below:

A) 1 and 2 only

B) 2 and 3 only

C) 1 and 3 only

D) 1, 2 and 3

5) The explainer notes a first-ever visit of the EU College of Commissioners to a bilateral partner outside Europe. This visit to New Delhi took place in:

A) February 2025

B) June 2025

C) September 2025

D) November 2025

6) The India–EU relationship is stated to rest on shared values and principles including:

1) Democracy

2) Rule of law

3) Rules-based international order

4) Commitment to effective multilateralism

Select the correct answer using the code given below:

A) 1 and 2 only

B) 1, 2 and 3 only

C) 2, 3 and 4 only

D) 1, 2, 3 and 4

7) Arrange the following in chronological order as mentioned:

1) Upgrade to Strategic Partnership at the 5th Summit in The Hague

2) First India–EU Summit in Lisbon

3) Adoption of “India–EU Strategic Partnership: A Roadmap to 2025”

Select the correct answer using the code given below:

A) 2–1–3

B) 1–2–3

C) 2–3–1

D) 3–2–1

8) The Trade and Technology Council (TTC) between India and the EU was launched in:

A) July 2020

B) May 2021

C) April 2022

D) February 2025

9) Consider the following locations where joint naval exercises/cooperation were mentioned:

1) Indian Ocean

2) Gulf of Guinea

3) Gulf of Aden

Which of the above is/are included in the described maritime security cooperation?

A) 1 only

B) 1 and 2 only

C) 2 and 3 only

D) 1, 2 and 3

10) With reference to the Clean Energy and Climate Partnership (CECP), which statement is correct as per the text?

A) It was established in 2021 and Phase III was adopted in 2025

B) It was established in 2016 and Phase III was adopted in November 2024

C) It was established in 2018 and Phase III was adopted in July 2020

D) It was established in 2020 and Phase III was adopted in March 2021

11) The India–EU Connectivity Partnership, as stated, was launched in:

A) 2016

B) 2017

C) 2020

D) 2021

12) The administrative arrangement to advance trilateral development cooperation between India and the EU was agreed in:

A) June 2025

B) September 2023

C) November 2025

D) December 2024

13) The India–Middle East–Europe Economic Corridor (IMEC) MoU was announced on the margins of which event, as mentioned?

A) G7 Leaders’ Summit, Canada (June 2025)

B) G20 Leaders’ Summit, New Delhi (September 2023)

C) India–EU Summit, Lisbon (June 2000)

D) EU College of Commissioners’ Visit, New Delhi (February 2025)

14) With reference to scientific cooperation, the India–EU Science and Technology Cooperation Agreement anchoring collaboration was signed in:

A) 2004

B) 2007

C) 2016

D) 2021

15) Consider the following statements regarding India–EU space cooperation as mentioned:

1) Indian satellites were launched using Europe’s Ariane launchers in the 1980s

2) ESA’s Proba-3 mission was launched by ISRO’s PSLV-XL in December 2024

3) The inaugural India–EU Space Dialogue was held in Brussels in November 2025

Which of the statements given above is/are correct?

A) 1 and 2 only

B) 2 and 3 only

C) 1 and 3 only

D) 1, 2 and 3